By David Snowball

Updates

Approach with caution, perhaps mixed with mild annoyance. Brown Brothers, Harriman announced a series of moves this month:

on September 9, 2019, they launched BBH Select Series – Large Cap Fund (BBLRX/BBLIX)

on September 20, 2019, they announced the closing of BBH Core Select (BBTEX) to new investors

on September 23, 2019, they announced the liquidation of BBH Core Select, effective October 9, 2019.

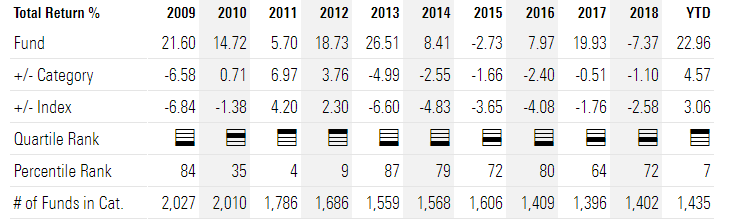

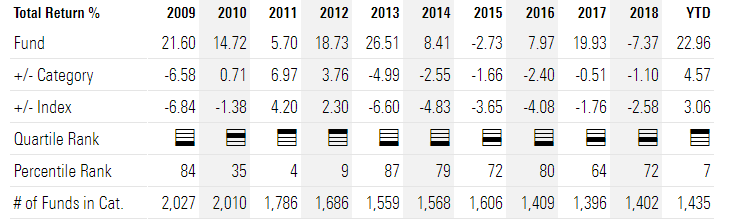

BBH Core Select was a superstar fund from 2005-12, and assets poured in. Over those years, it grew 20-fold in size to $6 billion. 2017 is the fund’s first above-average year since then and money has been rushing out the door: it appears to have had net inflows in one month between 2013-2018 and the incessant outflows have forced the managers to liquidate a portfolio with lots of embedded capital gains, which is causing more flight and is deterring new investments. Closing BBTEX at the same moment you open BBLIX effectively flips on a neon sign that reads “BBH Core Select without the tax risk: enter here!”

BBH Select Series-Large Cap Fund (BBLRX / BBLIX) is a clone of Core Select The prospectus is pretty explicit about the connection, as when it discusses “the performance of a composite of accounts managed by BBH&Co. that have investment objectives, policies and strategies substantially similar to those of the Fund (i.e., BBH&Co.’s Core Select Strategy).” The new fund’s expense ratios are 0.80% and 1.05% for Institutional and Retail, respectively, and the minimum initial investments are $10,000 and $5,000.

Three consequences of the change:

-

The remaining BBTEX shareholders become heir to the fund’s remaining tax bill. This is not structured as a tax-free reorganization.

-

BBH buries six years of mediocrity.

-

New BBRLX shareholders get to start with a clean tax slate, which might increase the prospect that there will be new BBRLX shareholders.

We called BBH after the liquidation of BBTEX was announced, asking for comment on why they’d chosen to liquidate the fund. The phone representative was unable to address the question and promised to forward it to people who could. As of our publication deadline, we haven’t heard back.

The prospectus for the US Vegan Climate ETF (VEGN) is now available for interested parties. It aspires to track the Beyond Investing US Vegan Climate Index which seeks to address the concerns of vegans, animal lovers, and environmentalists. Ummm… why exclude tobacco and guns? There are certainly perfectly fine reasons for doing so, but neither seems much implicated in either of the fund’s titular concerns.

Briefly Noted . . .

Thanks to The Shadow and the folks on MFO’s discussion board; the former for catching a bunch of interesting developments that were otherwise under the radar and the latter for helping to think through their significance. I enjoyed reading their discussions.

SMALL WINS FOR INVESTORS

Effective immediately, the O’Shaughnessy Market Leaders Value Fund (OFVIX), the O’Shaughnessy Small Cap Value Fund (OFSIX) and the O’Shaughnessy Small/Mid Cap Growth Fund (OFMIX) will no longer charge a redemption fee on Class I shares redeemed within 90 calendar days of purchase.

Effective December 2, 2019, purchases of Class A shares of PIMCO Short Asset Investment Fund (PAIAX) will no longer be subject to an initial sales charge or contingent deferred sales charge. This is a development worth noticing. When you see “cash” listed in the portfolio of one of the PIMCO funds, they don’t mean that the money is in a mayonnaise jar on Funk and Wagnall’s back porch. They mean it’s been invested, primarily, in commercial paper which is designed to be highly liquid with returns a bit greater than the rate of inflation. PAIAX is a mutual fund that gives retail investors access to that same conservative, strategic cash portfolio. Our profile of the fund, from 2013, concluded,

This fund will not make you rich but it may be integral to a strategy that does. Your success, like the ants, may be driven by two different strategies: never leaving a crumb behind and being ready to hop on the occasional compelling opportunity. PAIAX has a role to play in both. It does give you a strong prospect of picking up every little crumb every day, leaving you with the more of the resources you’ll need to exploit the occasional compelling opportunity.

Prospector Capital Appreciation (PCAFX) and Prospector Opportunity (POPFX) have both announced e.r. reductions of 5 bps. In the case of tiny but excellent funds, that’s sort of icing on the cake.

Effective September 13, 2019, Scharf Investments, will be reducing the Fund’s minimum initial investment for the Institutional of the Scharf Fund (LOGIX) from $5 million to $1 million.

CLOSINGS (and related inconveniences)

Effective at the close of business on November 8, 2019, Cohen & Steers Real Estate Securities Fund (CSIEX) will be closed to new investors.

I just report ‘em: “Effective at the open of business on September 16, 2019, shares of the Equable Shares Large Cap Fund (EQLIX) will be offered for purchase. Effective as of the close of business on September 18, 2019, the Fund will be closed to all new purchases.” Equable did the same shut/open/shut flutter with its small cap fund last month.

Effective September 10, 2019, James Alpha MLP Portfolio (JAMLX) closed to both new and existing shareholders. With $7 million in assets and a one-star rating, one imagines this is prelude to liquidation.

OLD WINE, NEW BOTTLES

Effective October 1, 2019, Advisory Research Emerging Markets Opportunities Fund (ADVMX) will change to Vaughan Nelson Emerging Markets Opportunities Fund and the five-star Advisory Research International Small Cap Value Fund (ADVIX) will change to Vaughan Nelson International Small Cap Fund. Each Fund’s investment objective and principal investment strategies will remain the same after the name change.

Effective November 4, ARK Industrial Innovation ETF (ARKQ) will be renamed ARK Autonomous Technology & Robotics ETF. Here’s the key: currently they focus on “industrial innovation” but soon they’ll focus on “disruptive innovation” (mostly industrial).

Perhaps responding to The Ohio State University’s attempt to trademark the word “The,” Baillie Gifford is getting out of The fund business and into the Baillie Gifford Fund business. Effective as of November 25, 2019, the name of each Baillie Gifford fund is changed as follows:

| Current Name |

New Name |

| The Asia Ex Japan Fund |

Baillie Gifford Asia Ex Japan Fund |

| The EAFE Fund |

Baillie Gifford International Growth Fund |

| The EAFE Choice Fund |

Baillie Gifford EAFE Plus All Cap Fund |

| The EAFE Pure Fund |

Baillie Gifford Developed EAFE All Cap Fund |

| The Emerging Markets Fund |

Baillie Gifford Emerging Markets Equities Fund |

| The Global Alpha Equity Fund |

Baillie Gifford Global Alpha Equities Fund |

| The Global Select Equity Fund |

Baillie Gifford Global Stewardship Equities Fund |

| The International Concentrated Growth Fund |

Baillie Gifford International Concentrated Growth Equities Fund |

| The International Equity Fund |

Baillie Gifford International Alpha Fund |

| The International Smaller Companies Fund |

Baillie Gifford International Smaller Companies Fund |

| The Long Term Global Growth Equity Fund |

Baillie Gifford Long Term Global Growth Fund |

| The Multi-Asset Fund |

Baillie Gifford Multi Asset Fund |

| The Positive Change Equity Fund |

Baillie Gifford Positive Change Equities Fund |

| The U.S. Equity Growth Fund |

Baillie Gifford U.S. Equity Growth Fund |

Boston Trust Asset Management Fund (BTBFX) has changed its name to Walden Balanced Fund (WSBFX). Collectively, the fund family moved from Boston Trust and Walden Funds to Boston Trust Walden Funds.

On or about November 1, 2019 Catalyst IPOX Allocation Fund (OIPAX) will become the Catalyst Enhanced Core Fund. When that happens, the mandate to focus on IPOs will be eliminated and expenses will drop substantially.

Sometime before year’s end (they’re not yet able to commit to a date) Cambria Core Equity ETF (CCOR) and its manager leave Cambria to become the Core Alternative ETF. They expect the e.r. to tick down, but everything else remains the same. It’s an options-based fund that’s had one relatively good year (top 3%) and one relatively bad one (bottom 10%), both with positive returns in the low single digits. The equation Core Equity = Core Alternative strikes me as odd since it suggests very different visions of the fund’s role and nature.

Effective as of December 1, 2019, the Cushing MLP Infrastructure Fund’s name and ticker (PIPEX, reflecting the focus of MLP’s on oil and gas pipelines) will change to the Cushing NextGen Infrastructure Fund (NXGNX). The high cost/low purpose “C” share class will, I’m glad to report, vanish. After the change their infrastructure focus will broaden to include “industrial infrastructure companies, sustainable infrastructure companies and technology and communication infrastructure companies.” They’ll also drop fees a bit and add three new co-managers.

Effective on or about October 14, 2019, the First Western Funds become the Oakhurst Funds. In particular,

| Current Name |

New Name and Ticker Symbol |

| First Western Funds Trust |

Oakhurst Funds Trust |

| First Western Fixed Income Fund |

Oakhurst Fixed Income Fund OHFIX |

| First Western Short Duration Bond Fund |

Oakhurst Short Duration Bond Fund OHSDX |

| First Western Short Duration High Yield Credit Fund |

Oakhurst Short Duration High Yield Credit Fund OHSHX |

Following a change of the underlying index, on October 1, 2019, SPDR Nuveen S&P High Yield Municipal Bond ETF (HYMB) becomes SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF. Changes between near-identical indexes are usually driven by company financials: if Bloomberg will license use of their index for substantially less than S&P charges, the fund will flip.

Steben Alternative Investment Funds, advisor to the Steben Managed Futures Fund (SKLAX) is being bought by Octavus Group, LLC, advisor to the LoCorr Funds. One senses a name change on the horizon. The fund isn’t as bad as it, at first glance, looks. It missed a massive move by its benchmark index that occurred during the fund’s first 11 months of operation, but it’s been solid since.

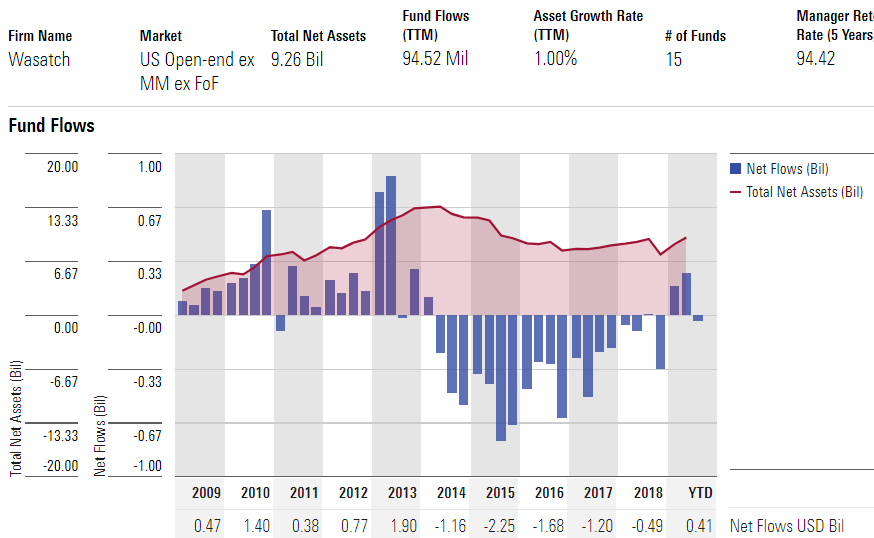

As of September 24, 2019, Wasatch Advisors has rebranded as Wasatch Global Investors. Wasatch’s president Eric Bergeson argues that “Global” better reflects “our global business” and the fact that almost half of their assets are in global and international strategies. Skeptics on the MFO discussion board promptly identified the change as a marketing strategy. Given five years of steady outflows, enhanced marketing is surely warranted.

One speculation was that the firm might be marketing itself, potentially to a European acquirer.

Less low: On or around November 1, 2019 Westwood Low Volatility Equity Fund (WLVIX) becomes Westwood Total Return Fund. As now, it will seek total return but it will no longer promise “a lower level of volatility than traditional equity-oriented strategies over a market cycle” and it will no longer constrain itself to be 80% invested in equities.

On the same day, Westwood Short Duration High Yield Fund (WSDAX) becomes Westwood High Income Fund and it also dispenses with the “while experiencing lower volatility” piece. Westwood Market Neutral Income Fund (WMNUX) becomes Westwood Alternative Income Fund but they merely tweak the wording in their mandate without noticeably changing it.

OFF TO THE DUSTBIN OF HISTORY

AdvisorShares New Tech and Media ETF (FNG) will be liquidated on October 11, 2019. The fund managed to lose 27% last year and 34% so far this year, turning a $10,000 initial investment into $5,123 … and, I guess, a nice tax deduction? I’m guessing that the fund’s ticker is a nod to its initial enthusiasm for FAANG stocks.

Alambic Mid Cap Plus Fund (ALMGX) and Alambic Small Cap Plus Fund (ALGSX) closed to new investments on September 23, 2910 and will discontinue their operations effective October 28, 2019. The funds have $4 million between them; to their credit, much of it is their managers’ money. Small Cap started strong, then tailed off. Mid Cap never had noticeable traction in either performance or marketing.

AlphaCentric Small Cap Opportunities Fund (SMZAX) gave its two weeks’ notice and liquidated on September 27, 2019.

Altegris/AACA Real Estate Income Fund (INMAX) will be liquidated on October 28, 2019. The fund has just $200,000 in assets, none of it from its managers.

The Board of Trustees of American Beacon Funds has approved a plan to liquidate and terminate the American Beacon Ionic Strategic Arbitrage Fund (IONAX) on or about October 15, 2019.

American Century Adaptive Equity (AMVIX) failed to adapt. It remains open to new investments until November 11 but will liquidate one month later.

AMG Managers Amundi Intermediate Government Fund, AMG GW&K U.S. Small Cap Growth Fund (ATASX), AMG Managers Amundi Short Duration Government Fund and AMG Managers Essex Small/Micro Cap Growth Fund (MBRSX) will all be liquidated on or about October 29, 2019.

The Chadwick & D’Amato Fund (CDFFX) will cease operations on October 28, 2019. It’s a $33 million tactical allocation fund whose tactics have earned it about 3% a year over the past decade.

CVR Dynamic Allocation Fund (CVRAX) becomes a former fund on Halloween, October 31, 2019.

Direxion Daily Euro STOXX 50 Bull 3x Shares (EUXL), Direxion Daily High Yield Bear 2x Shares (HYDD) and Direxion Daily 7-10 Year Treasury Bear 1x Shares (TYNS) will all liquidate on October 18, 2019.

HSBC Asia ex-Japan Smaller Companies Equity Fund (HAJAX) and HSBC Emerging Markets Debt Fund (HCGAX) will cease its investment operations and liquidate their assets on or before October 28, 2019.

In cleaning up after their acquisition of the Oppenheimer funds, Invesco has announced a long series of liquidations:

Invesco Tax-Exempt Cash Fund

Invesco OFI Pictet Global Environmental Solutions Fund

Invesco Strategic Real Return Fund

Invesco Alternative Strategies Fund

Invesco Multi-Asset Inflation Fund

Invesco Emerging Markets Flexible Bond Fund

Invesco Oppenheimer Global Unconstrained Bond Fund

Invesco Oppenheimer Preferred Securities and Income Fund

Invesco Oppenheimer SteelPath MLP & Energy Infrastructure Fund

Invesco Oppenheimer SteelPath Panoramic.

Folks following Invesco/Oppenheimer might want to review an extended and thoughtful discussion of the merger on MFO’s discussion board.

James Alpha MLP Portfolio (JAMLX) has closed to new investors. That announcement said nothing to imply the fund’s imminent demise but a $7 million asset base and one-star rating implies a short stay in hospice.

JOHCM US Small Mid Cap Equity Fund (JODIX) will liquidate on October 11, 2019. Tiny fund with tepid results. It was managed by a London-based team who’d moved from Fidelity’s quant division, Pyramis, to J O Hambro to manage the strategy.

JPMorgan Emerging Economies Fund (JEEAX) undergoes liquidation and dissolution on or about October 24, 2019

None of Lazard Emerging Markets Income (LEIOX), Lazard Explorer Total Return (LETOX) and Lazard US Realty Equity (LEROX) will survive Halloween, 2019. It’s in the best interest of their shareholders, we’re told, that they go. It’s easy to make that case for the first two (small and stumbling) funds, harder with the four-star, Bronze-rated Realty Equity fund. The fund, in both good years and bad, leaked assets.

The $7 million Mount Lucas U.S. Focused Equity Fund (BMLEX) will cease its business, liquidate its assets and distribute its liquidation proceeds on or about October 25, 2019. It’s not a bad little fund, but it appears that a major investor left in late 2016, taking two-thirds of the fund’s assets when it left. They haven’t been able to gain market traction since.

Segall Bryant & Hamill Smid Cap Value Dividend Fund (WTSDX) will be liquidated on or about October 29, 2019. The good news was that flows were pretty stable, the bad news was that the fund still had under a million in assets.

Trillium All Cap Fund was authorized in 2015 but never launched. The advisor has determined that the shares will never be offered. I keep rooting for Trillium: a rare women-owned advisor, experienced managers, ESG focus, $500 million in assets, one pretty solid fund and one pretty weak one.

Early this year, the NYSE gave USCF Summerhaven SHPEN Index Fund (BUYN) six months to find at least 50 shareholders or face delisting. They haven’t managed that yet, but have been given an additional three months before facing the prospect of delisting. Losing money in each of its two years of existence, and losing money this year while its peers are nearing double-digit gains, has made that task difficult.

VanEck Vectors High Income Infrastructure MLP ETF (YMLI) is winding down, a process which is expected to be complete on or about October 25, 2019.

As of December 1, 2019, VanEck Vectors High Income MLP ETF (YMLP) will change:

-

- its name, to VanEck Vectors Energy Income ETF

- its benchmark

- its investment objective

- its investment policy

- its investment strategies

- its tax status and

- its fees.

Otherwise nothin’ to see here folks, just move along.

And to you all, for reading and reflecting with us. I’d be especially delighted to meet any of the folks who might be attending the annual AAII convention in Orlando in a few weeks. I’ll be there, speaking … well, at around the time most convention attendees will be boarding their flights home. Such is life. It will give us the opportunity to have a nice discussion with the folks who do attend. The theme of my presentation is how to be a long-term investors in a world filled with … well, sound and fury, signifying nothing.

And to you all, for reading and reflecting with us. I’d be especially delighted to meet any of the folks who might be attending the annual AAII convention in Orlando in a few weeks. I’ll be there, speaking … well, at around the time most convention attendees will be boarding their flights home. Such is life. It will give us the opportunity to have a nice discussion with the folks who do attend. The theme of my presentation is how to be a long-term investors in a world filled with … well, sound and fury, signifying nothing.

Another example, and then I will move on. Some years back I was in a supermarket located in that triangle area of Massachusetts within spitting distance of New York and Connecticut. I was watching a direct store deliveryman for a potato chip company fill up his section of the salty snack aisle. (FYI – hands up those who think you can learn more about brands and what the competition is doing by talking to the direct store deliveryman or, instead of by sitting at the well-scrubbed set of presentations at a company’s analyst day). The gentleman noticed that I was looking for something and asked if he could help. I mentioned a special brand of potato chip that his company made. I had purchased it when in the DC and Virginia areas. He said that was their best selling and best tasting potato chip – and the only one that they still cooked in lard. He told me that I wouldn’t find it in Massachusetts or Connecticut. This apparently was the dictate of the health police. I wonder what they would make of poutine sold everywhere in Quebec – but I digress.

Another example, and then I will move on. Some years back I was in a supermarket located in that triangle area of Massachusetts within spitting distance of New York and Connecticut. I was watching a direct store deliveryman for a potato chip company fill up his section of the salty snack aisle. (FYI – hands up those who think you can learn more about brands and what the competition is doing by talking to the direct store deliveryman or, instead of by sitting at the well-scrubbed set of presentations at a company’s analyst day). The gentleman noticed that I was looking for something and asked if he could help. I mentioned a special brand of potato chip that his company made. I had purchased it when in the DC and Virginia areas. He said that was their best selling and best tasting potato chip – and the only one that they still cooked in lard. He told me that I wouldn’t find it in Massachusetts or Connecticut. This apparently was the dictate of the health police. I wonder what they would make of poutine sold everywhere in Quebec – but I digress.